China Market - Social Media & Influencers

Social Media

Social media platforms used in China are very different to those used in the rest of the world as the likes of Facebook and Instagram are blocked. Instead, China has its own equivalents but often these platforms far surpass their Western counterparts in terms of functionality and ease of use. Chinese people are the most connected people in the world, particularly via mobile, and spend an average of 3 hours a day browsing social media apps. As such, the importance of social media in China should not be underestimated. These platforms allow brands to get closer to their customers, sharing information and activity while building relationships and trust.

There is a wide array of various apps and platforms, however the key platforms are:

WeChat – a multi-purpose messaging, social media and mobile payment app developed by Tencent. It has over 1 billion active monthly users and has been described by Forbes as one of the world’s most powerful apps. It is known as a ‘super app’ because of its wide range of functions and platforms. Asking importers about their WeChat set up and capabilities should certainly be a question raised during discussions and negotiations as WeChat can be a very powerful marketing and sales tool. Some wine companies now use WeChat as their primary sales channel.

Weibo – a micro-blogging site with similar functionality to Twitter but with a considerably higher character limit for original posts.

QQ – an instant messaging app that was the first product released by Tencent. Its demographics trend towards the young and unsophisticated. They are less likely to hail from Tier 1 cities, and 60% are under 30 years old.

Youku – the second largest video site in the world after Youtube.

Tencent Video – a video streaming site similar to Youtube.

Douyin/TikTok – hosts entertaining, eye-catching user-generated photos and primarily videos, which are now often used for the promotion of consumer goods brands. These are typically light-hearted and humorous videos of only 15-60 seconds.

Douban - very similar to MySpace, popular with special interest groups and communities, and for networking around specific topics. It has over 100 million users and its most active users are intellectuals and pop culture junkies looking for movie, music and book reviews.

Setting up and maintaining social media platforms in China can be time consuming and expensive as you need to create engaging content in Chinese to keep and attract new followers. This may involve hiring Chinese staff or working with an agency. To stand out from the crowd, a significant amount of investment is usually required to advertise your social media accounts. This may make sense for larger brands but the primary option for smaller enterprises is to leave the marketing of products in the hands of a well-chosen distributor. Asking your distributor for details about their digital strategy, including social media, is highly recommended.

Traditional vs Digital Media

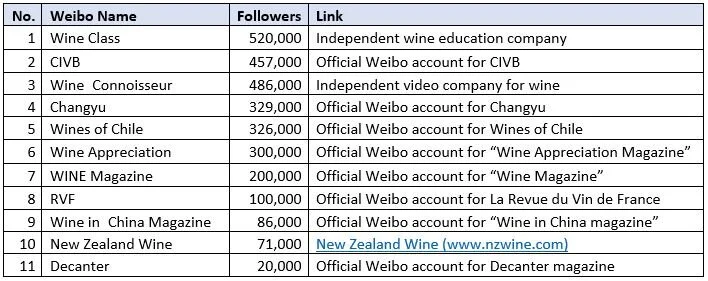

Traditional wine publications are limited in China as most content is published and read online. Below is a list of the top 10 most influential wine organisations active in China (not exhaustive) based on their number of Weibo followers:

When it comes to spirits, DRiNK Magazine, Ask Jerry, Whisky Magazine China and Bartalk, are the leading platforms, promoting and supporting the ever growing bar and spirits industry.

KOLs

KOLs (Key Opinion Leaders) are an incredibly important part of brand promotion in China due to restrictions on advertising. They comprise famous actors, singers, TV personalities, web celebrities and bloggers. Their influence is particularly pronounced within the fashion, beauty and luxury goods markets. Many are hired by brands to create social media content and share this with their many thousands/millions of followers. They command commissions for their endorsements such that the more clicks per post, the more they get paid.

Care must be taken however to find KOLs who are genuinely engaged with the brand as consumers are now wise to KOLs pushing products just because they’re being paid large sums of money to do so.

Micro Influencers

As a result of consumers becoming more savvy in this respect, micro influencers are on the rise. These also comprise bloggers and livestream video personalities but also business owners and people of influence within their spheres that command a great level of respect because they offer their genuine opinions. When it comes to wines and spirits most of the influencers sit within this group, rather than true KOLs.

Some key influencers in the wine industry in China include:

Masters of Wine

Ms Fongyee Walker MW, her husband Edward Ragg MW and Julien Boulard MW are currently the MWs living and working in Mainland China.

There are also a handful operating out of Hong Kong that are somewhat active in Mainland China, including: Debra Meiburg MW, Jeannie Cho-Lee MW, Sarah Heller MW, Jennifer Dougherty MW.

Sommeliers

Lu Yang MS

There are some top sommeliers that have influence in the market as follows:

LU Yang MS, only Master Sommelier from China, earning the famous pin in 2017. Currently Corporate Wine Director for Shangri-La Hotels globally.

Li Meiyu, Wine Director of Park Hyatt Beijing

Guo Ying, Former Senior Sommelier of Four Seasons Hotel China (now based in London)

Jerry Liao, Hotel Sommelier at Shangri La Hotels and Resorts

Tansy Zhao, Sommelier Mandarin Oriental Hotel Pudong

Arneis Wu, Sommelier at Joel Robuchon Shanghai

Kerry Qin, Sommelier at Bellagio Hotel Shanghai

Writers & Critics

The media, critic, journalist, and educator environment in China is notoriously fragmented and unusually blurred across lines, even as far as the line between commentary and commercial activity. There is no critic that has come to lead the field in China as would the likes of Robert Parker in the USA or Jancis Robinson in the UK.

CH’NG Poh Tiong, wine columnist in the Wine Review, who is Singapore-based

James Suckling, critic, writer and hosts his annual ‘Great Wines of the World’ events in Beijing and Hong Kong, in close collaboration with COFCO.

Lin Yusen, Taiwanese wine writer

Lady Penguin

Below is a list of top individual wine influencers and influential platforms active in China:

· Lady Penguin, independent influencer, strong following with younger consumers

· Bettane Desseauve, French wine critics

· Li Demei, wine expert/professor

· Xiao Pi, Terry Xu, wine lecturer, creator of wine related content

· Frankie Zhao, wine expert

· Sophie Liu, wine educator

· Julien Boulard MW, wine educator, blogger

· Vinehoo, online wine platform

· Corinne Mei, AWSEC

· Maxime Lu, wine expert, blogger

· Leon Liang, founder of Shanghailander

· Andy Tan, educator, specialises in Burgundy

· Edward Ragg MW, founder of wine school Dragon Phoneix

· Sam Cheng, educator, specialize on Spanish wines

· Black Wine Guide

· Taste Spirit

· Shanghailander/Grapea

Bastien Ciocca and Hope & Sesame’s team

Influential Bar Owners & Mixologists

Jin Zhong Lei, aka Kin (Constellation Group)

Bastien Ciocca (Hope & Sesame)

Cross Yu (Epic)

Daniel An (Arch)

Michael Chen (Cannery)

Yao Lu (Union Trading)

Kevin Song (Scandal)

Digital Sales & Marketing

E-commerce is an incredibly fast growing channel in China, however, sales for wine online have thus far proven less successful compared to other consumer products. The investment costs and specialized digital marketing strategies required to make noise and be noticed on the giant e-commerce platforms such as T-mall and JD.com is simply outside of the capability of most wineries today. Smaller, online players who specialize in wine and spirits such as 1919.cn, Bottles XO, Vinehoo, Lady Penguin, will be better suited to the majority of drinks brands. If you are thinking about selling online, a separate digital strategy must be created to generate successful sales, particularly via the top social media platforms e.g. WeChat and to a lesser extent these days, Weibo.